Environmental, Social, Governance Policy Management System

As part of the 2030 Agenda, which aims to provide a global framework for sustainable development, the European Union has committed to unifying its sustainability goals with the Union's policy framework and to fully implementing the 2030 Agenda.

With the recently enacted Sustainable Finance Disclosure Regulation (SFDR) on sustainability-related disclosure requirements in the financial services sector (2019/2088 of 27 November 2019) and the Taxonomy Regulation (2020/852 of 18 June 2020), the EU aims to facilitate the taking up and pursuit of the activities of alternative investment fund managers (AIFMs) managing or distributing alternative investment funds, including managers of qualifying venture capital funds (EuVECA managers), and in particular to standardize the protection of investors.

These regulations aim to create transparency in the relationship between fund managers and investors with respect to the inclusion of sustainability risks, the consideration of adverse sustainability impacts and the promotion of environmental or social features as well as with respect to sustainable investments.

Brightpoint strives to provide a transparent, sustainable and responsible service chain and investment infrastructure to clients, investors, employees and other stakeholders.

Background elements for the introduction of an active ESG management system at Brightpoint are:

- Conviction of the shareholders and of the management that sustainable behavior in the company can contribute significantly to a better future.

- Self-evident for Brightpoint, as an enabler and service provider, to responsibly promote and positively influence the further growth of our industry in Germany as a business location.

- Demand from clients who want a sustainable service provider either for strategic, compliance or fundraising reasons.

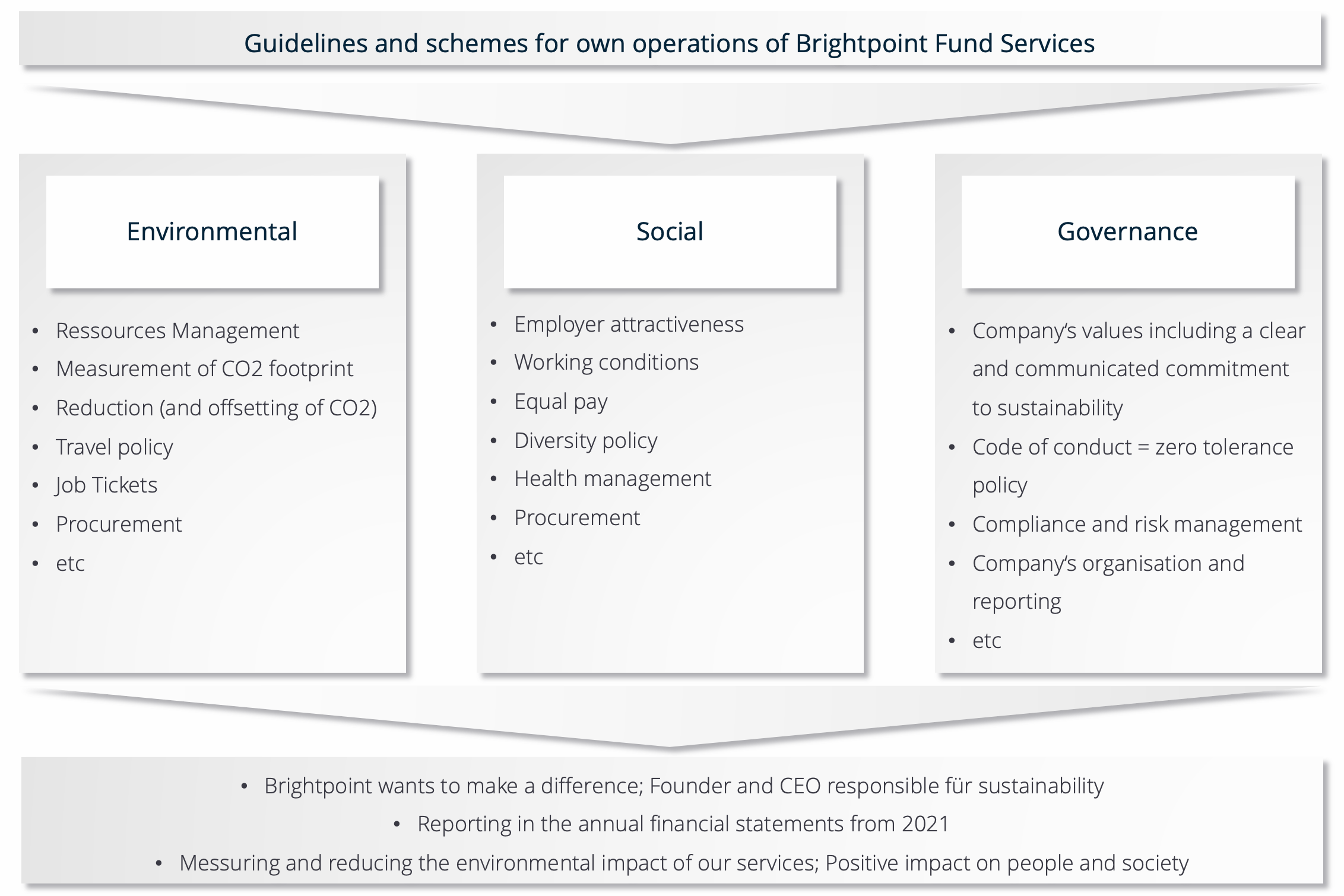

ESG management takes place at two levels: at the level of Brightpoint Fund Services as a company and at the level of Brightpoint Capital Invest's investment strategy.

1. Sustainable and responsible conduct at the level of Brightpoint Fund Services

The path to sustainability is uncomfortable, but it is as urgent as it is important. We are convinced to avoid harmful behavior and to advocate positive impacts wherever possible.

A. Environmental

In our daily office routine, we generally pay attention to environmentally friendly behavior (lighting, electricity consumption, water consumption). Here are some examples in detail:

We have a travel policy with extensive avoidance of flights and car trips: Whenever possible, our employees travel by train to out-of-town business appointments and conferences, etc. We also largely avoid all domestic travel. We also largely avoid all domestic flights. In addition, we have company accounts for shared car services so that we can avoid cab journeys wherever possible within the main major cities, provided that there are sufficient options for travel.

We promote commutation to work by public transportation: All employees are provided with tickets for public transport. In this way, we avoid the daily journey to work by car. In the future, when selecting offices, attention will be paid to the provision of bicycle parking spaces. No new company car contracts will be promoted. Our mobility policy will be continually developed in line with requirements (Bike Leasing).

We work paperless: At Brightpoint, we work largely paperless in all areas. Whether invoices, notes, vacation management or documents for meetings and presentations - all documents are digital. Unnecessary printouts are always avoided. The use of e-signature platforms eliminates the need to send documents by mail. A clause for the use of e-signatures has been introduced in fund contracts.

We take care of the small things in everyday life that save resources: Instead of PET bottles, we use a water dispenser connected to the tap water, rely on reusable glass bottles for drinks, and a capsule-free coffee machine. Our soaps are free of microplastics and new mobile devices are ordered exclusively via secondary market platforms such as "refurbed" or "backmarket".

Member of Leaders for Climate Action

Our goal: to remain climate-neutral and maintain a sustainable planet. To do this, we are guided by the Leaders for Climate Action (LFCA) Green Pledge.

We are a proud member of LFCA, a coalition of startups and funds working together to use their influence and network to make a difference in the fight against climate change and for a sustainable world.

Profound change always starts with ourselves: To gain awareness of the consequences of our actions, each leader commits to measuring, offsetting and reducing their own CO2 emissions wherever possible. In addition, as part of our business model, we also participate in other actions and training measures of the LFCA and have appointed a colleague as Climate Officer.

Measuring our impact

Because every action counts, we take responsibility for calculating our environmental impact. We work with one of the world's leading carbon offset providers to measure and offset our total environmental impact each year using internationally recognized parameters.

We have also set ourselves the goal of making the environmental impact of our service transparent. An internal project team has been set up for this purpose.

B. Social

Our employees are the cornerstone of our company's success. They represent our company to customers and other stakeholders. We value their trust in us as an employer and treat them as equals.

We are committed to being a good employer, which means in detail:

We comply with all labor and social security laws as a matter of course, including the non-discrimination principle, freedom of association and trade unions, etc.

We maintain high standards of occupational safety.

We ensure non-financial incentives and a high level of health protection (height-adjustable desks, ergonomic chairs, free drinks - water, coffee, tea, supply of fresh fruit).

We pay attention to fair conditions in the workplace and adequate remuneration.

We attach great importance not only to further training but also support permanent learning (seminars, webinars, office trainings and regular off-site trainings lasting several days).

The responsible induction of new colleagues is supported by careful on boarding plans, a buddy system and interim feedback.

We support the personality reflection of our employees through appropriate evaluations and annual structured feedback discussions.

As a social contribution, we are a training company despite our small size. We are active partners of the HSBA and thus create qualified jobs; we participate in workshops at universities and are open for (school) internships.

Through our lived diversity in the management team, we take responsibility in numerous initiatives as role models and mentors.

We allow flexible working hours and part-time contracts for employees with families and support parental leave for fathers and their return to work after parental leave.

Equal pay is a key element of our HR policy.

C. Governance

Fair, responsible and sustainable conduct is one of the top management principles of our company.

In our business model, transparent compliance with all legal and organizational governance is a top priority to protect our customers, investors and all stakeholders.

As members of Invest Europe and the BVK, we are committed to the code of conduct and the handbook for professional standards. These are an integral part of the on-boarding materials for new employees.

Due to the strategic importance of sustainability for Brightpoint, we have established sustainability management at C-level; an employee closely linked to the CEO is dedicated to ESG management as Climate Officer. Among other things, she is tasked with data collection and analysis as well as sustainable purchasing in Office Management.

We have implemented a responsible purchasing policy and buy used refurbished IT hardware.

We have introduced numerous elements of good governance and a compliance management system (e.g., confidentiality, data protection, AML).

A comprehensive compliance management system will be implemented in 2021. This includes:

- A code of conduct

- Transparent measures to prevent corruption and bribery and a gift policy

- A whistleblowing system

- Regulation on conflicts of interest and insider knowledge

- Clear process for "non-compliance"

We work in principle with the 4-eyes principle as standard to minimize risks. Due to the growth of the company, we will systematize process and risk management in 2021.

D. Summary

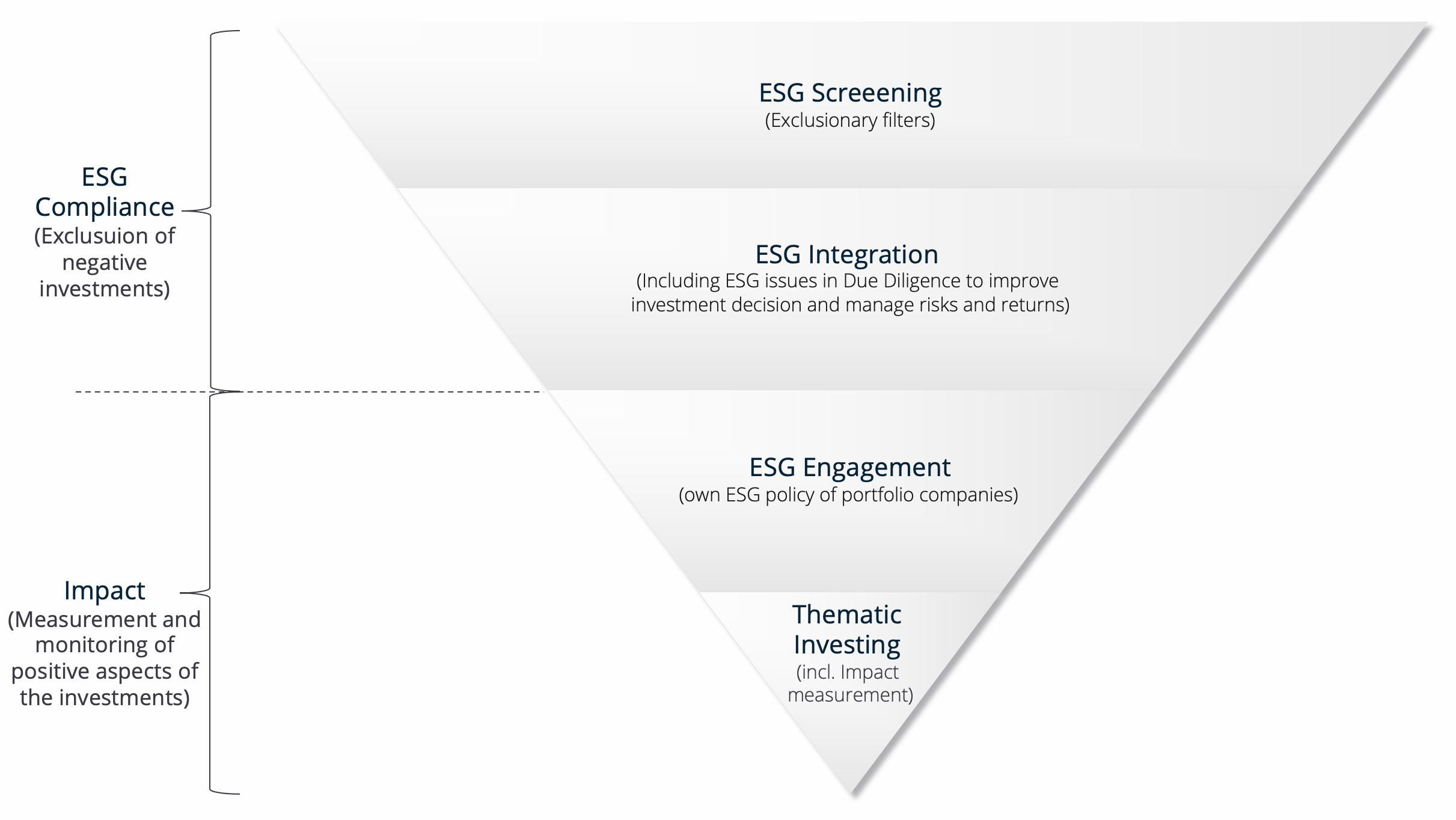

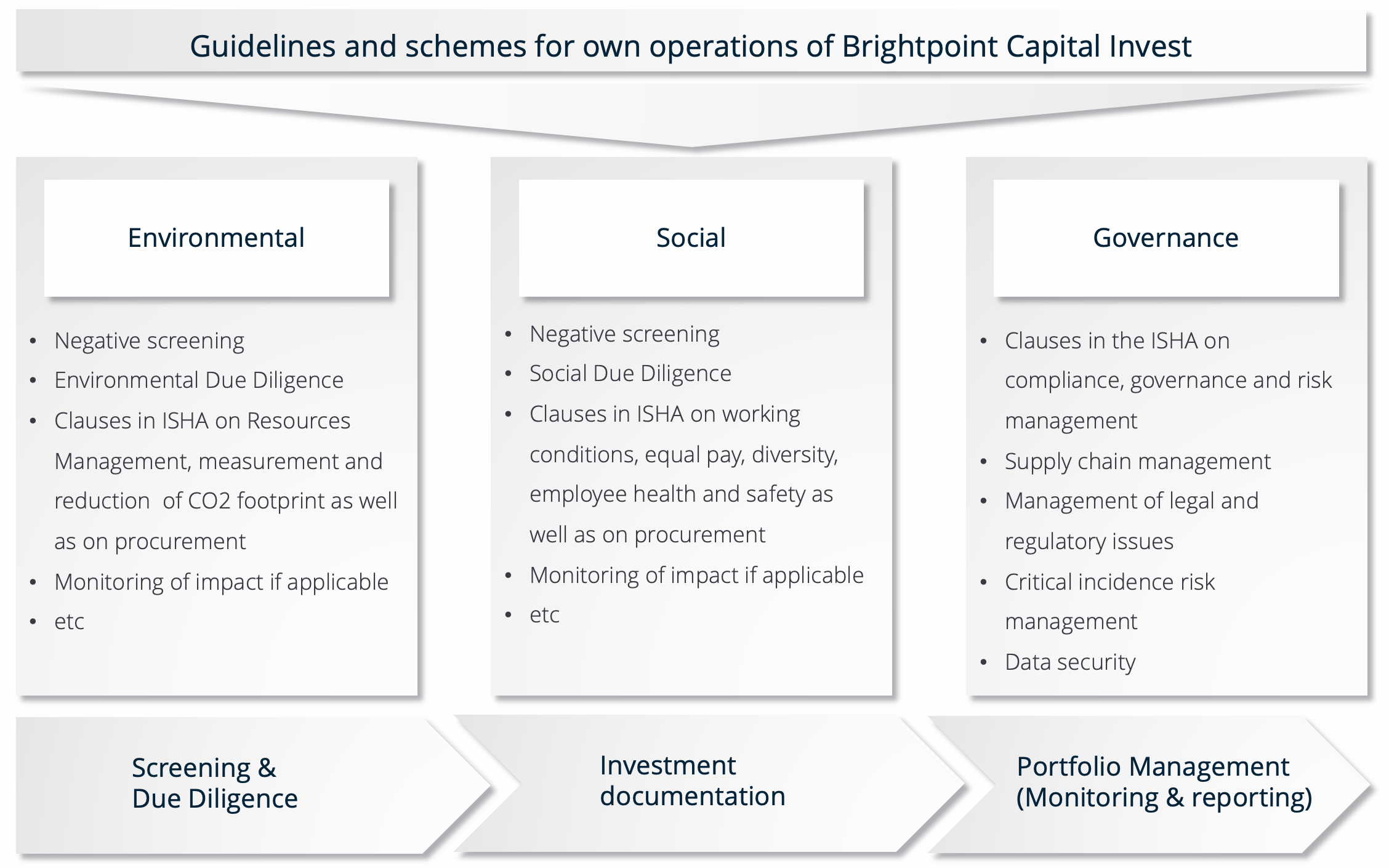

2. Sustainable and responsible investing at the level of Brightpoint Capital Invest GmbH

The fund has committed via

Leaders for Climate Action (LFCA) to include ESG issues in contractual documentation where possible.

Brightpoint Capital Invest is a service investment company that offers infrastructure solutions to initiators, banks and family offices. We do not pursue our own dedicated investment strategy, but as an issuing house we always launch investment projects in cooperation with partners and funds of funds.

Therefore, the selection of initiators and distribution partners with whom we cooperate is of particular importance for us to act responsibly as a service AIFM.

The business model is opportunistic, but in the future, we will pay more attention to sustainability in our investments.

A. ESG-Screening

First and foremost, Brightpoint Capital Invest excludes investments that would be detrimental to ESG criteria:

environmental aspects (nuclear power, coal for power generation, genetically modified organisms, biocides, wild-caught animals, palm oil)

social aspects (arms networks and weapons, pornography, alcohol, tobacco, gambling, exploitation of child labor)

ethical and corporate governance aspects (corruption, lobbying with the aim of lowering sustainability standards, disregard for human rights, political or religious objectives).

The fund also excludes investments in high-risk jurisdictions under FATF-GAFI. In other monitored jurisdictions (i.e., those classified as weakly supervised/non-transparent/non-cooperative in terms of money laundering/tax fraud/evasion/harmful tax practices), very strict checks must be carried out in this regard.

B. ESG-Integration

There will be an item in the investment decision memo being developed where ESG risks will be assessed. Documents that are not available in the data room can/should be requested as needed. If it is not possible to review these items, this must be explicitly noted in the investment memo.

C. ESG Engagement

Due to the business model of Brightpoint Capital Invest (fund investments and initiator funds), an influence on the portfolio companies is only possible to a very limited extent. Nevertheless, we will promote the ESG topic both for the funds of Brightpoint Capital Invest and for the customers of Brightpoint Fund Services. We are strategically and selectively expanding this area in 2021. A new offering has already been included in the Standard Service Agreement.

D. Impact Investing

Due to Brightpoint Group's business model, the issue cannot be addressed strategically. Brightpoint Capital Invest can select special impact initiators and strive to get fund projects that have a positive environmental, social or good governance impact, whether conventional funds or impact funds. Currently, some ESG-oriented fund projects still tend to have smaller fund sizes, so Brightpoint Capital Invest, as a service AIFM, can make a positive contribution to getting smaller fund projects off the ground in a reasonable and economically viable way.

In Brightpoint Fund Services, the new ESG policy and ESG reporting offering is intended to create a USP that makes Brightpoint particularly attractive as a fund manager for impact funds and significantly advances the impact measurement of funds overall. Thus, Brightpoint can also contribute to sustainable and responsible investing through its service portfolio.

Maren Eckloff-Böhme, CEO & Managing Partner